2023-01-04 • Dual Investment: APY Paying. Capital Insured - Unlimited Profit

Share this article

An innovative method that helps investors seek infinite profits while risk is controlled through capital hedging.

CoinStrat is pleased to announce a breakthrough method to invest safely and earn infinite profits. At the moment, the current dual investment feature allows us to receive APY. Investors can buy low or sell high and get fixed APY at the delivery time. The feature that is about to be released in the near future will accomplish dual investment as a whole, which is called: Dual Investment - APY paying. This article will deep dive into it and give more insights about this novel investment method.

WHAT IS DUAL INVESTMENT?

Dual Investment is a disruptive innovation of the financial investment industry ingeniously applied to the CryptoCurrency industry.

REASON OF DUAL INVESTMENT

Dual Investment has a mission to free investors from old, complicated, low-return and high-demand financial products. It also provides a breakthrough financial access opportunity for all people around the world regardless of their class, location and assets.

HOW DOES DUAL INVESTMENT WORK?

Dual Investing overcomes the weaknesses of the old investment methods, which rely solely on technical and fundamental analysis models that have existed for hundreds of years. The advantage is that we can get a guaranteed rate of return (APY receiving feature) or vice versa, we can minimize the risk thanks to capital insurance while the potential profit will be limitless. (APY paying feature).

WHAT IS APY PAYING?

Paying APY means you will pay a fee for the time you hold the position, this is known as the premium, to ensure that if the order does not go the way you want, you only have to pay the fixed percentage based on the order volume.

For example: You execute an order with a volume of $1000, the fee for that order is $10. That means when you lose, you only lose a maximum amount of $10. On the contrary, if the market moves in the right direction, you will receive profits that can be infinite, because the assets you hold can increase many times in just one night so you can make a profit by selling the asset at market value.

Receiving APY is the first version in dual investment with Buy Low - Sell High feature with average overnight interest rate ranging from 0.5-0.6% per day, this is the return that is sure to be received when the payment date comes but there is a risk if the market is not going in the right direction that you have analyzed.

So, APY paying is a piece of the puzzle to complete this, in APY paying there will be the opposite order: Buy High - Sell Low.

BASIC TERMS OF DUAL INVESTMENT

What is CoinStrat's APY paying feature in dual investment?

Target price: A pre-determined fee to hedge capital risk, but the potential return can be infinite.

Fee / day: Is the percentage of fees in 1 day multiplied by your order volume. The number of profits investors can achieve can be up to 10% - 20% in one night. But the fee of APY paying is only about 0.6% - 1%.

Delivery date – due date: is the determined date to receive profits.

DUAL INVESTMENT - A TWO-WAY MONEY MAKING METHOD

Buy High: Investors have the option to buy at a price higher than the current price, you only need to pay a cost to insure the investment capital but the profit will be infinite if the price of that asset increases better than expected the next day.

Sell Low: Investors have the option to sell at a price lower than the current price on the expiration date, the risk will be guaranteed and the profit will be enormous if the price of that asset class drops sharply on the day after.

Here are 2 examples of Buy High and Sell Low

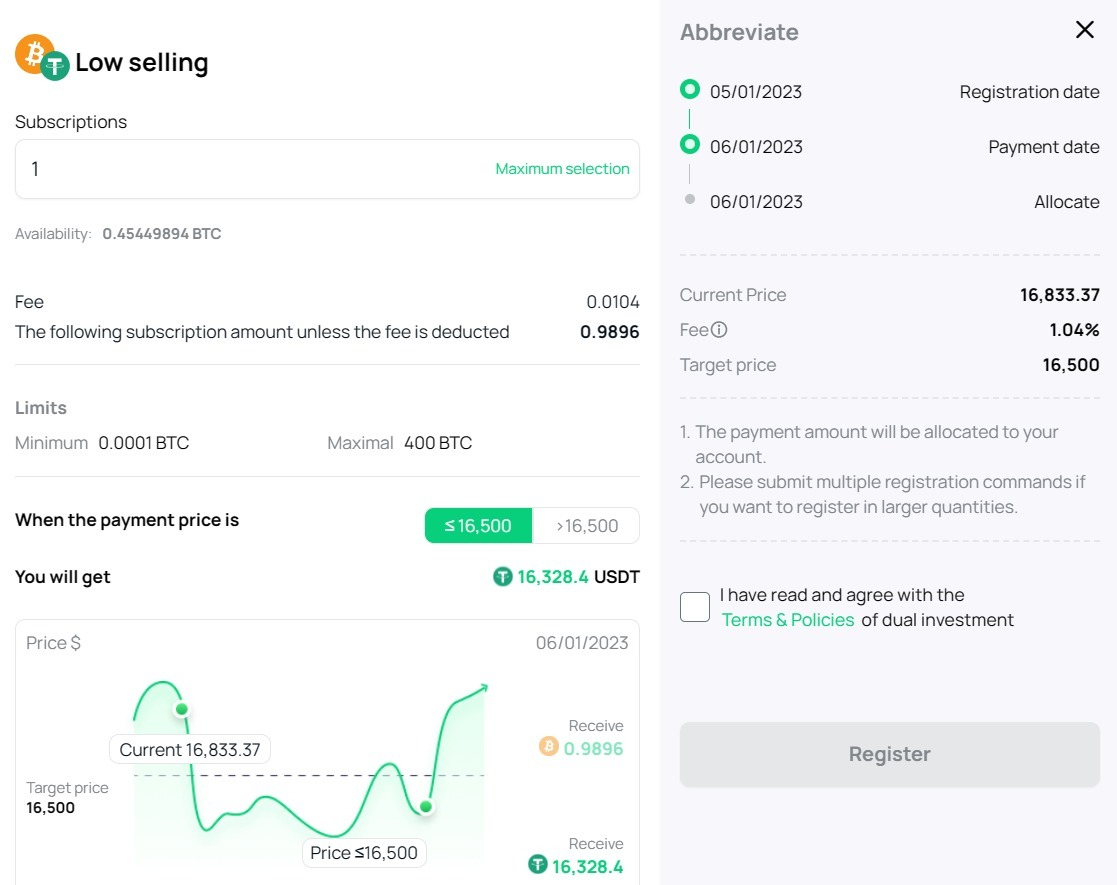

When enter “Sell Low” order, you need to have BTC in your wallet.

Target price 16,500 – Current price 16,833 – Entry volume 1 BTC – Fee / day is 1.04%

Scenario 1: On the settlement date, if the market price is above the target price, the order will not be executed, you will receive BTC back and a fee of 1.04% will be deducted from the total amount of the order.

For example: When you enter 1 BTC, if you do not match the order, you will receive 0.9896 BTC

Scenario 2: If the BTC price is less than or equal to the target price on the day of settlement, your order will be executed, which means that you will sell low 1 BTC at 16,500 and received in USDT. The amount you will receive after fee deduction is 16,328 USDT.

However, if the BTC price falls below 16,500, falling deeply to the price of 15,000, your order is filled at the target price of 16,500 and you enjoy additional profit from the price difference. Because the price of BTC plummeted, if you then convert from USDT to BTC by trading at the current price, you will get more BTC.

Calculate profit as follows: 16,328/15,000 = 1.0885 BTC. The amount of BTC you have left over is 0.0885 BTC, so you still preserve 1 BTC of your initial investment and have a surplus of 0.0885 BTC, equivalent to 1,327 USDT.

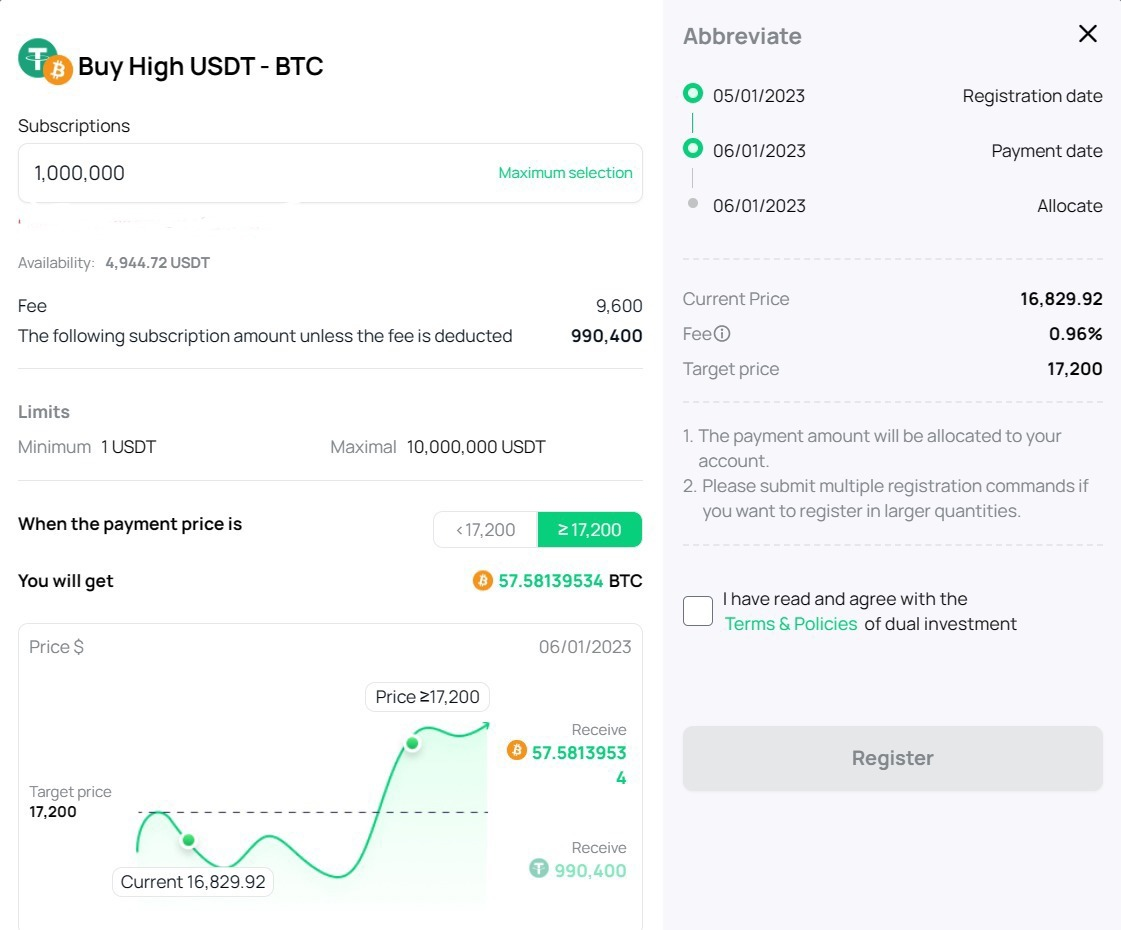

When enter “Buy High” order, you need to have USDT in your wallet.

Target price 17,200 – Current price 16,829 – Entry volume 1,000,000 USDT – Fee / day 0.96%

Scenario 1: If the market price is lower than the target price on the settlement date, the order will not be executed, you will receive the principle in USDT and a fee of 0.96% will be deducted from the total amount entered.

Example: Enter a Buy High order of 1,000,000 USDT, if the order is not executed, you will receive 990,400 USDT.

Scenario 2: If the BTC price settlement date is greater than or equal to 17,200, your Buy High order is executed at the target price of 17,200 and you will receive the asset in BTC. The amount you will receive after fee deduction is 57.58139 BTC.

However, if the BTC price goes higher than 17,200, rising to the price of 20,000, which means that you have bought BTC at the target price of 17,200 and you will profit from the difference by selling BTC at the market price of 20,000. So in total, you get back 1,151,627 USDT, which means 151,627 USDT profit after just one night.